7 key pieces of advice for Private Equity Funds

Thursday, June 22, 2023Article

We attended the leading Private Equity Insights conference in Warsaw, Poland in May.

During the panel, Partner Bartek Krawczyk focused on sharing best practice from the top performing private equity firms, that you might want to discuss further and test in your organisations.

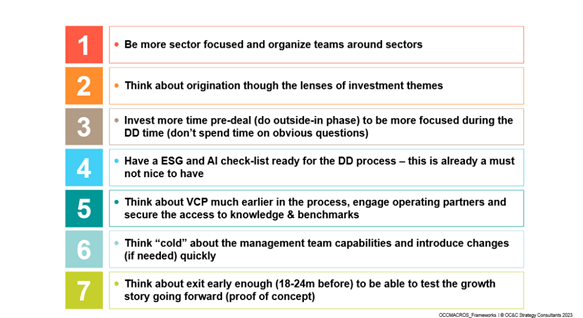

Here are the 7 key pieces of advice we’ve put together to ensure you capitalise on the opportunities that come your way:

- Be more sector focused and organise teams around sectors

- Think about origination, through the lens of investment themes

- Invest more time pre-deal (do outside-in phase) to be more focused during the Due Diligence (don't waste time on obvious questions!)

- Have an ESG and AI checklist ready for the Due Diligence process; this is a must

- Think about VCP much earlier in the process - engage operating partners

- Think "cold" about the management team capabilities and introduce changes quickly (if needed)

Think about exit early enough (18-24 months prior) to be able to test the growth story going forward (proof of concept)

Think about exit early enough (18-24 months prior) to be able to test the growth story going forward (proof of concept)

To find out more about how best to approach any stage of the process, get in touch: